Leveraging its comprehensive energy storage supply chain database, InfoLink Consulting has unveiled the global ESS shipment rankings for the first half of 2025 (1H25). During this period, the global ESS market sustained a robust growth trajectory, with total shipments hitting 167.1 GWh—representing an impressive year-on-year (YoY) surge of 85.7%. While China and the Americas remained key drivers of market expansion, both the Europe, Middle East, and Africa (EMEA) region and the Asia-Pacific (excluding China) market delivered standout performances, each achieving YoY growth exceeding 150%.

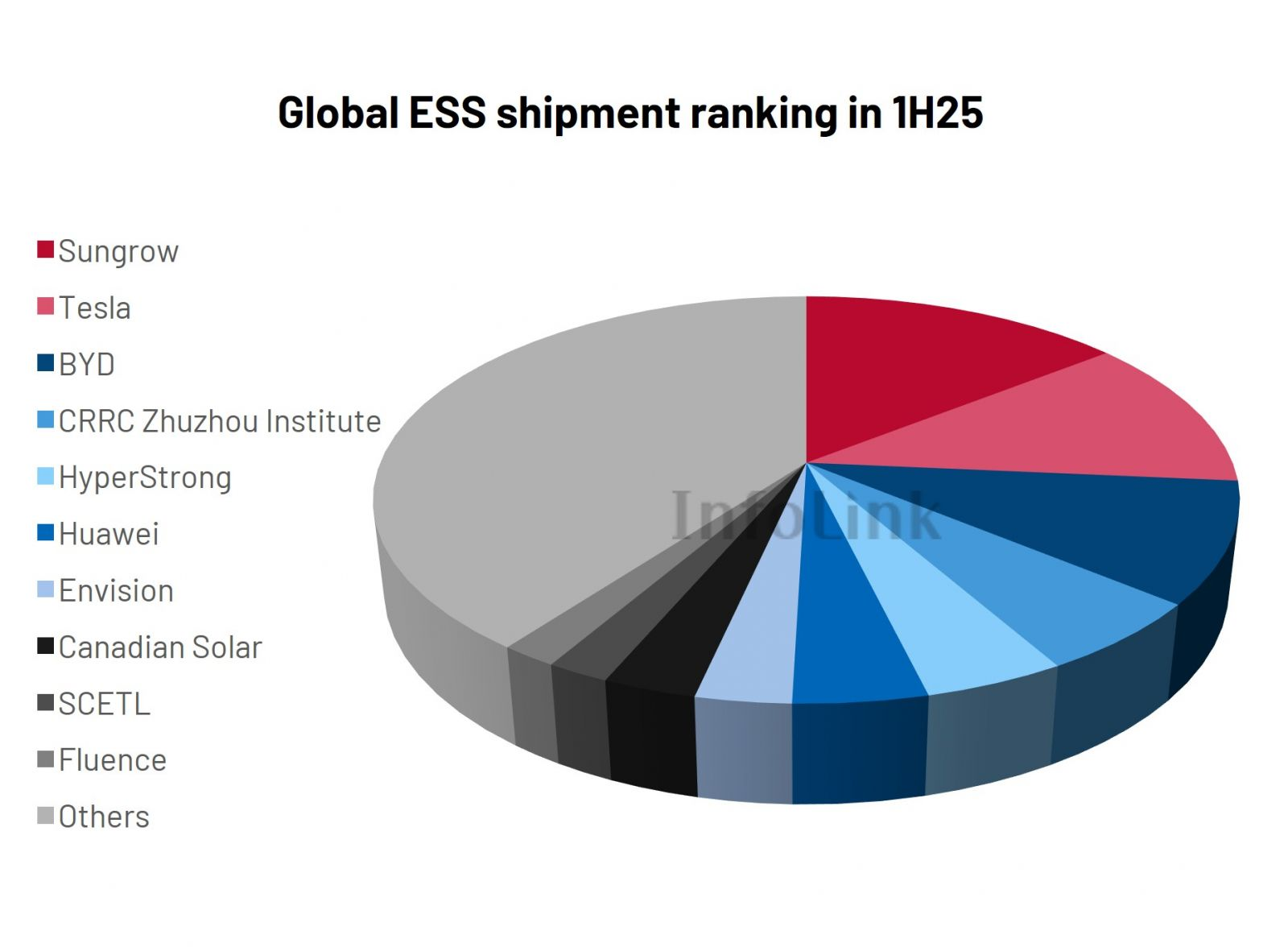

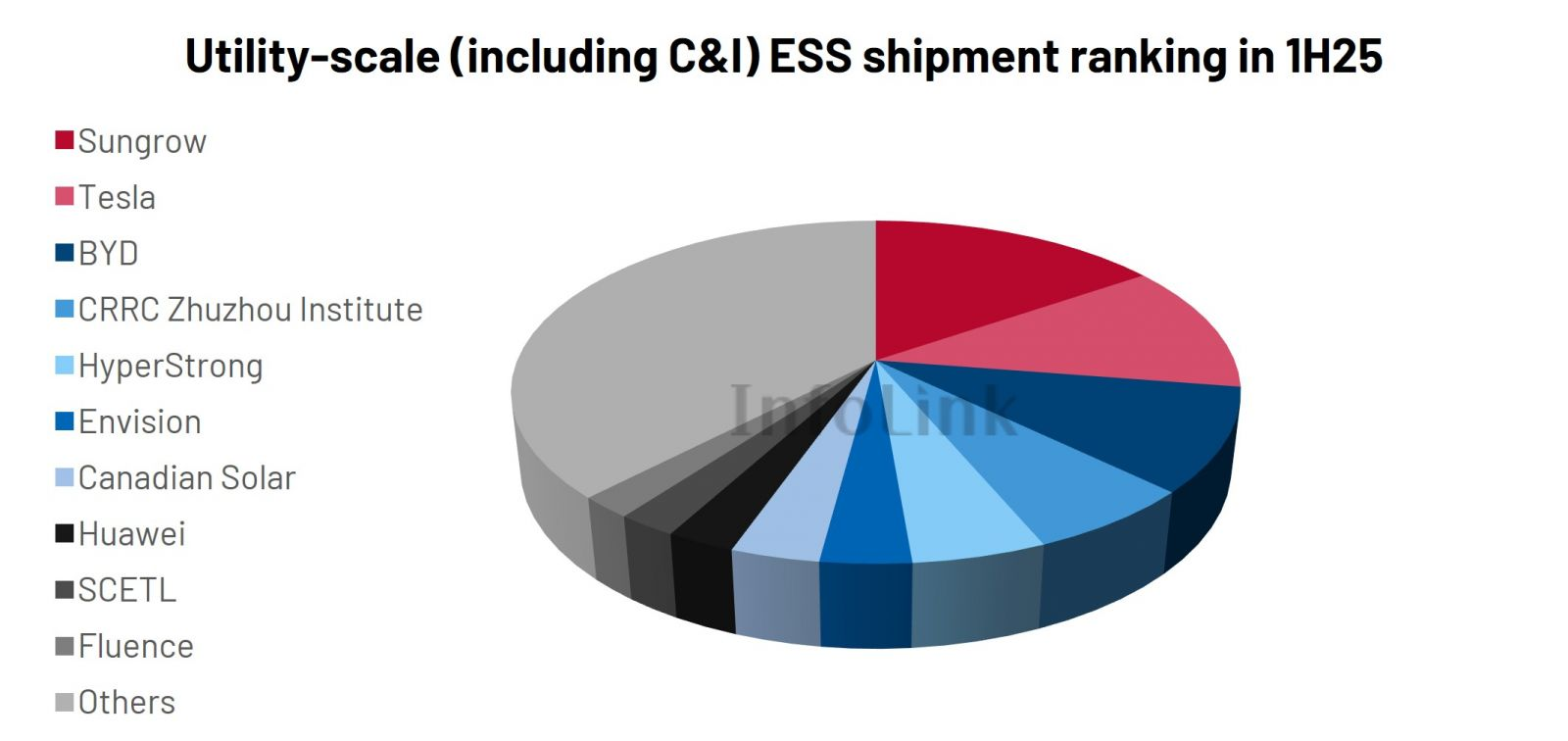

Fierce Competition Persists in the ESS Segment, with Market Leaders Emerging The top five global ESS suppliers in 1H25 were identified as Sungrow, Tesla, BYD, CRRC Zhuzhou Institute, and HyperStrong. Four key trends defined the market dynamics during this period:

*Source: InfoLink’s Global Energy Storage Supply Chain Database

1. Intensified Competitive Landscape A notable contrast emerged between the ESS segment and the energy storage cell sector: while the top 10 cell suppliers captured 91.2% of the market (CR10), the ESS segment’s CR10 stood at just 60.2%. This gap underscores a significantly higher level of competition in the ESS space. 2. Clear Tiered Differentiation Among Suppliers The top three ESS providers maintained a distinct lead over smaller competitors, highlighting obvious tiered differences in market positioning. Importantly, this top-three pattern has remained unchanged for two consecutive quarters. Given the existing project pipelines of each enterprise, industry analysts anticipate that the top-three rankings will stay relatively stable for the entire 2025 calendar year. 3. Coexistence of Multiple Strong Players Currently, leading companies from diverse sectors—such as photovoltaic (PV) modules, wind turbines, new energy vehicles (NEVs), and inverters—have expanded into the battery energy storage system (BESS) integration market. This cross-sector entry has intensified rivalry among the top 10 ESS suppliers. Looking ahead, the ESS segment is likely to evolve toward a market structure characterized by the coexistence of multiple dominant players. 4. Muted Performance of U.S.-Based Suppliers In contrast to 2024, when Chinese and U.S. suppliers competed head-to-head for market share, U.S. players showed overall weakness in the 1H25 rankings. Tesla was the only U.S. firm to secure a top-tier position, holding onto second place, while Fluence slipped to the brink of the top 10. Among other U.S. enterprises, NextEra ranked between 11th and 15th, and Powin continued its downward trend as it remained in restructuring.

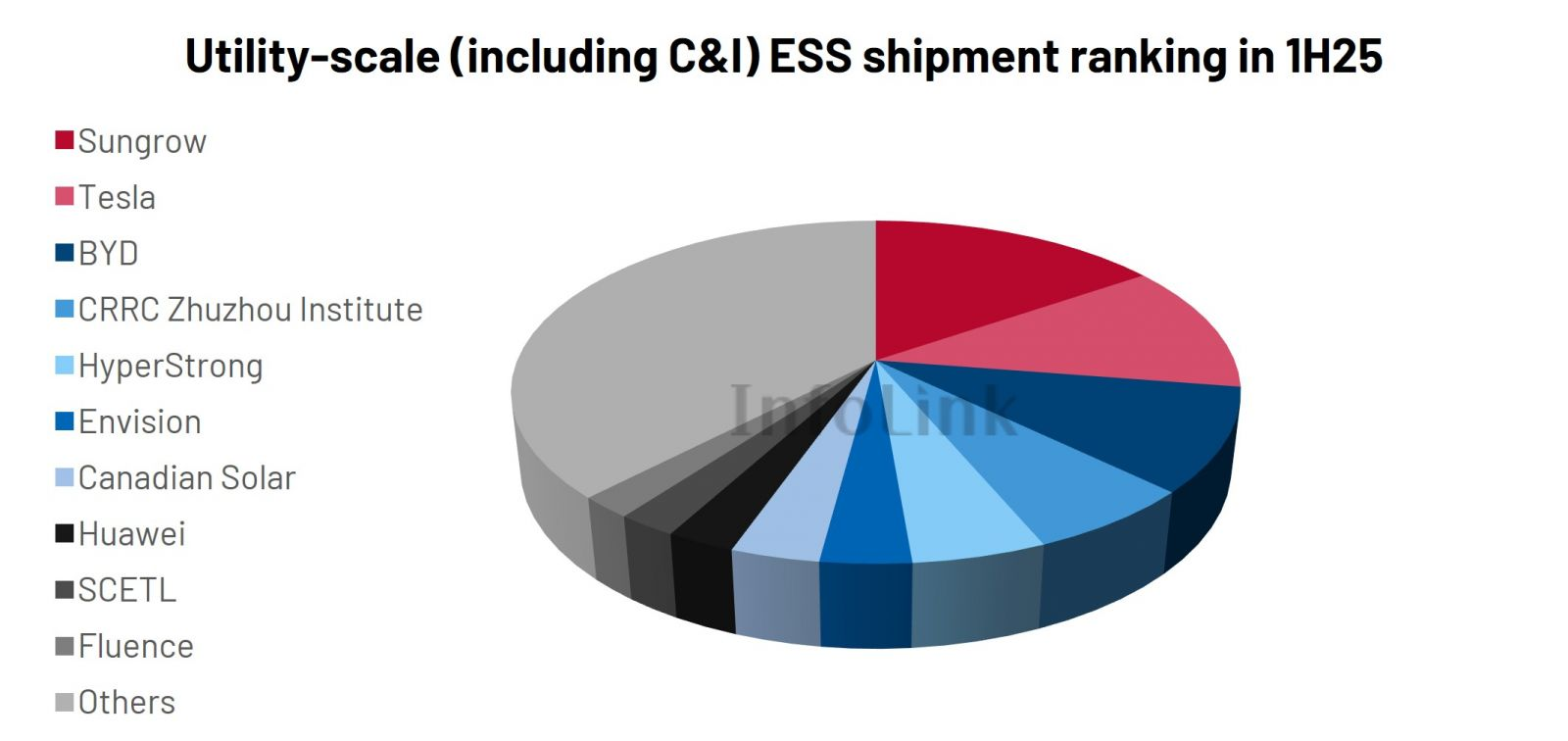

Utility-Scale ESS Nears 150 GWh in 1H25; Sungrow Poised for Full-Year Leadership Global shipments of utility-scale ESS reached 147.6 GWh in 1H25, with the top five suppliers mirroring the overall ESS segment: Sungrow, Tesla, BYD, CRRC Zhuzhou Institute, and HyperStrong. Sungrow is widely expected to claim the top spot in the full-year rankings, while Tesla and BYD are set to engage in fierce competition for second place. Additionally, the first half of 2025 saw a surge in the launch of independent energy storage projects in Inner Mongolia (China). This development could enable Envision to leverage its project presence in the region and challenge for a position in the top five during the second half of 2025 (2H25).  *Source: InfoLink’s Global Energy Storage Supply Chain Database DC System Segment: Focus on Vertical Integration and OEM Transformation In the DC system segment, the top five suppliers in 1H25 were CATL, BYD, Hithium, RelyEZ, and PotisEdge. During this period, industry attention centered on two key areas: the progress of vertical integration among battery cell manufacturers and the transformation of original equipment manufacturers (OEMs) in the system integration space. Looking ahead to 2H25, the commissioning of several non-China-based projects is expected to pave the way for leading DC integrators to gradually enter the rankings of the terminal AC system segment.

*Source: InfoLink’s Global Energy Storage Supply Chain Database In the DC segment, the top five DC system suppliers in 1H25 were CATL, BYD, Hithium, RelyEZ, and PotisEdge. During the period, the focus remained on vertical integration progress among cell manufacturers and the transformation of system integration OEMs. In 2H25, as some non-China projects come online, leading DC integrators may gradually enter the rankings on the terminal system (AC) side.

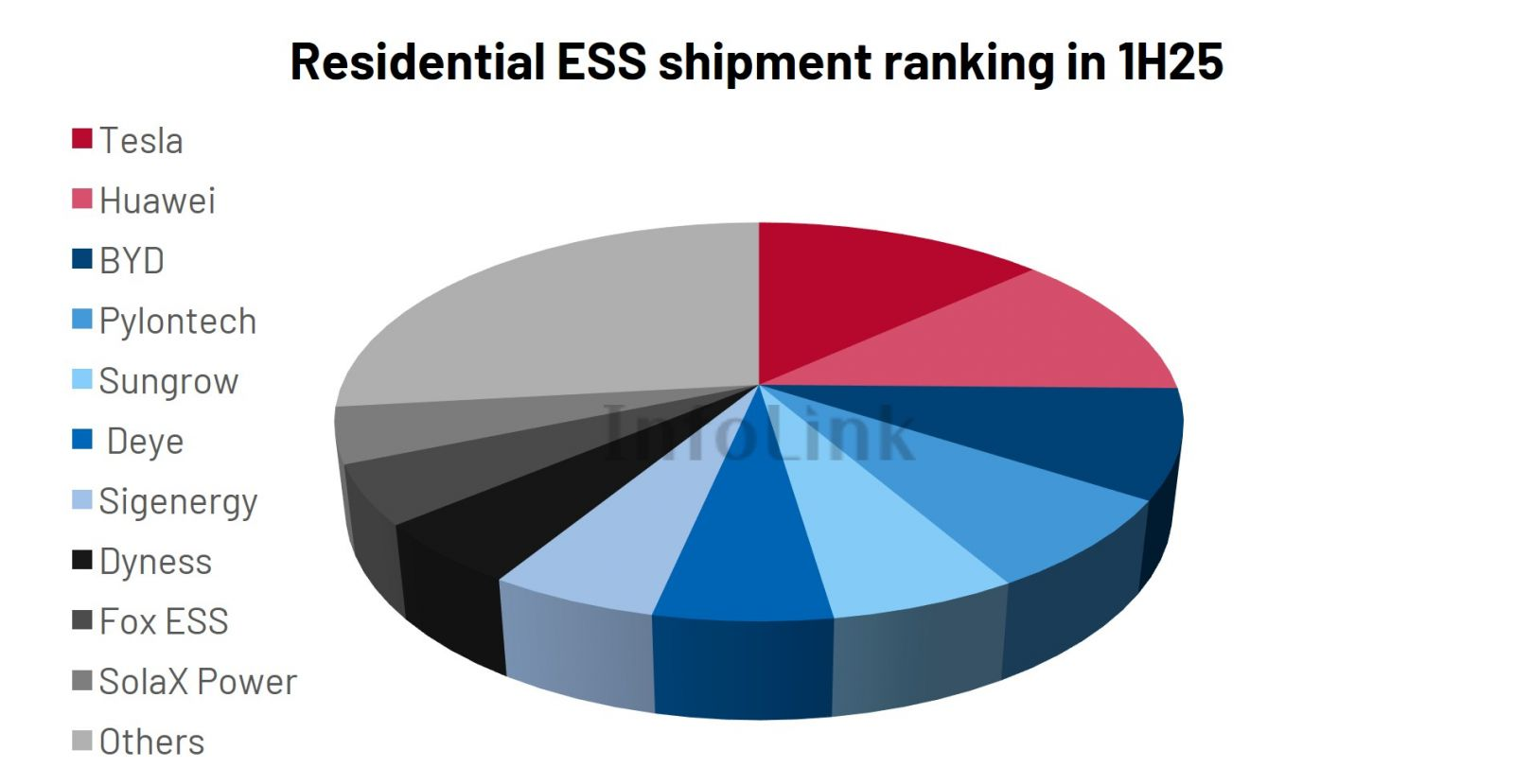

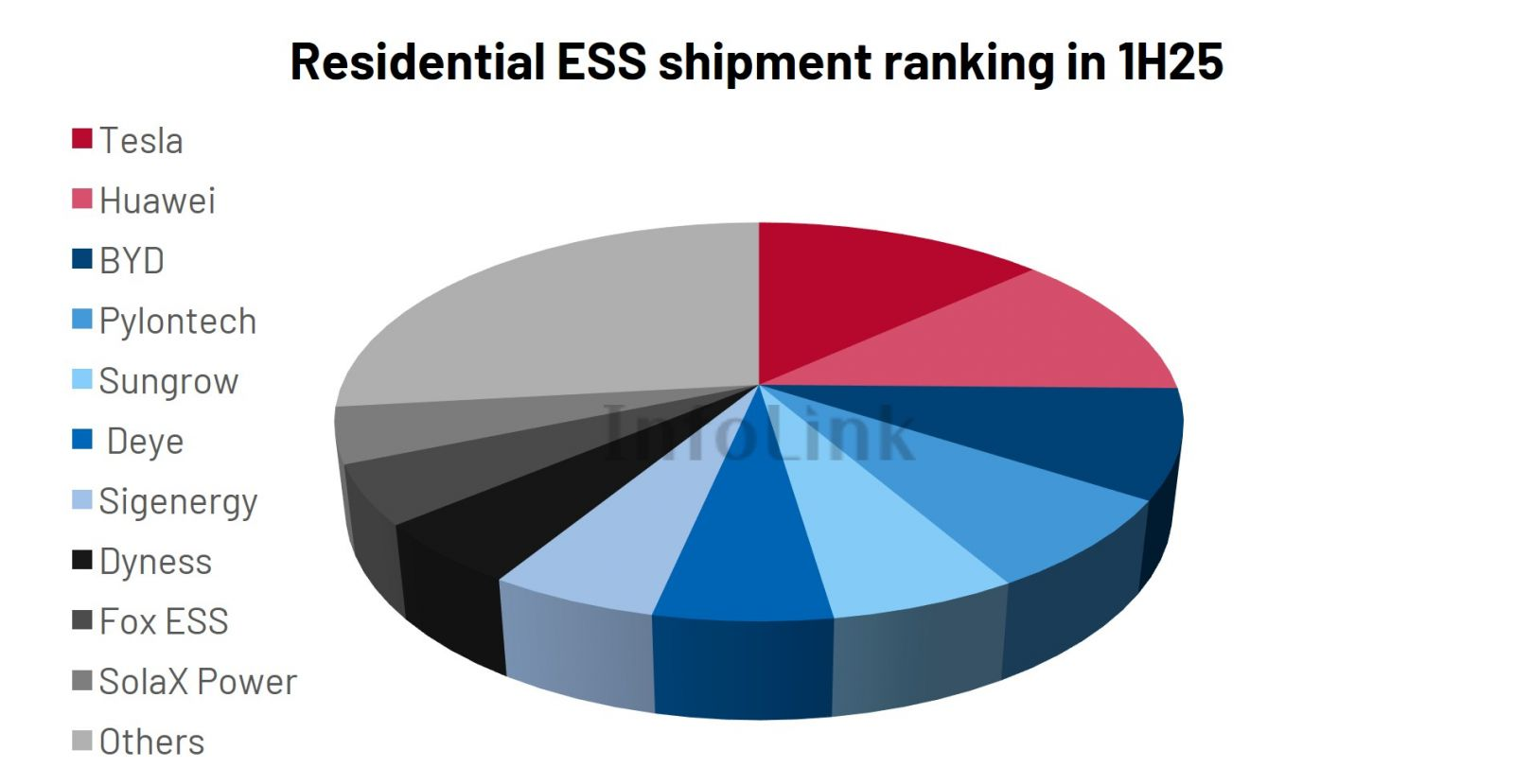

Residential ESS Shows Clear Upward Momentum; Tesla, Huawei, BYD Lead the Pack Global shipments of residential ESS reached 16.6 GWh in 1H25, with a distinct upward trend observed in the second quarter (Q2) when viewed on a quarterly basis. The top five suppliers in this segment were Tesla, Huawei, BYD, Pylontech, and Sungrow. Competition in the residential ESS market remains intense, as evidenced by a top-five concentration ratio (CR5) of only 47.7%. Furthermore, tiered differentiation among the top 10 residential ESS suppliers was clearly visible, with shipment volumes roughly divided into three tiers: the 2 GWh tier, the 1–1.5 GWh tier, and the 0.5–1 GWh tier. For the full year, the Australian market is expected to be the biggest wildcard. Tesla, Sungrow, and Sigenergy are projected to capitalize on their existing channel advantages in Australia to further strengthen their market positions.

*Source: InfoLink’s Global Energy Storage Supply Chain Database Full-Year Outlook: Sustained Growth Amid Regional Diversification From a full-year perspective, the global ESS market is poised to maintain rapid growth. Europe and emerging markets are expected to gradually increase their share of global shipments, while the relative shares of China and the U.S. will continue to decline. As ESS shipment destinations become increasingly regionally diversified, the ability of suppliers to build and enhance global operational capabilities has become a focal point of industry attention. At the same time, despite the overall expansion of the global market, profitability among second- and third-tier ESS suppliers has yet to show significant improvement. How these companies can break free from the pressures of intensifying competition will remain a key issue to monitor for the remainder of 2025.

Data source: InfoLink Statement: The purpose of reprinting this article is to disseminate more information. Some of the images and texts are sourced from the internet. If there is any infringement, please contact us for removal. |